If a customer purchases when rates are low they maintain that price locked in also if the broader rate of interest setting increases. However, residence customers pay a costs for securing assurance, as the interest rates of set rate loans are typically greater than on adjustable rate mortgage. Federal government backed programs including FHA, VA & USDA fundings are quickly reviewed.

The most significant advantage of having a fixed rate is that the house owner understands exactly when the rate of interest and also major repayments will be for the size of the car loan. This permits the house owner to budget much easier due to the fact that they understand that the rates of interest will certainly never ever alter for the duration of the finance. A home loan by conditional sale is when the debtor markets the residential or commercial property to the mortgagee on the problem that the sale will end up being outright if there is a default of settlement. Additionally, on the settlement of the cash, the sale will certainly become gap and the mortgagee will move the residential or commercial property back to the mortgagor. Than on the majority of various other lendings, offering somewhat lower month-to-month payments in the beginning. 2- and also five-year bargain periods are the most common, as well as when you get to completion of your fixed term you'll usually be proceeded to your lending institution's common variable price.

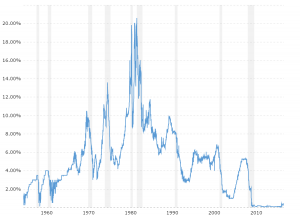

The following table allows you to compare current prices and monthly settlements for numerous common home mortgage types. Over a collection period of time, you obtain a discount rate on the lender's SVR. This is a sort of variable rate, so the quantity you pay every month can transform if the lender modifications their SVR, which they're totally free to do as they like. Or, a mortgage with a rate that runs over the entire term of your mortgage.

Countless people have actually used our economic recommendations via 22 books published wfg success rate by Ramsey Press, as well as two syndicated radio shows as well as 10 podcasts, which have over 17 million regular listeners. The subprime home mortgage was made to bring the desire for homeownership within every person's reach-- also for individuals who are having a hard time economically. A buydown is a home mortgage funding technique where the customer attempts to get a lower rate of interest for at the very least the home loan's first few years however potentially for its lifetime. Home top 5 timeshare companies loans are finances that are used to purchase homes as well as various other kinds of property. © 2022 NextAdvisor, LLC A Red Ventures Firm All Civil Liberties Reserved.

There are usually no Very early Payment Costs if you want to switch over away from your lending institution's SVR. After the fixed duration surfaces, you will generally move onto your loan provider's Criterion Variable Rate, which is likely to be more expensive. If your repaired price deal is involving an end in the next couple of months, it's a good idea to start looking around currently.

- This suggests buyers don't have to bother with saving as much for their down payments, and they can save their cash for repair services of emergency funds.

- For example, the residential or commercial property value of 'Z' is 1,00,00,000 has been given as protection to the 'Bank of Baroda' for the financing of 10,00,000.

- Bankrate.com does not include all firms or all available items.

- An applicant can approve as much as 100% of the down-payment in the type of a present from a loved one, pal, company, philanthropic group, or federal government buyer program.

Your house or home may be repossessed if you do not maintain settlements on your home loan. The additional safety and security of this type of deal implies that rate of interest tend to be somewhat more than the best marked down or tracker prices. There will also normally be an Early Settlement Charge if you repay the home mortgage in full as well as remortgage to an additional bargain. Thus, this type of home loan does not need any type of writing, and also being an oral transaction is not impacted by the Legislation of Registration. When it comes to English Home loan, the debtor transfers the ownership of the mortgaged home absolutely to the mortgagee as safety and security.

How Home Mortgages Work

In such an instance, he acquires a mandate for the sale of the home. Area 68, if a basic mortgagee sues for enforcement of his security, a mandate for ownership would certainly be prohibited. It would also not run as repossession rather it would certainly transform a straightforward mortgagee right into a mortgagee having belongings.

Analysts and professionals alike concur in the verdict that the industry is slowly but continuously getting momentum and that this is a pattern that will hold for the rest of the year. For potential house customers, this means that this is the time to do research on home mortgage car loan options and also to make a step faster instead of later on. With a shut home loan, the borrower may pick a fixed rate or variable/adjustable rate depending upon their requirements or choice. A closed mortgage is a commitment with a pre-determined interest rate, over a pre-determined period of time.

Life

We preserve a firewall software between our marketers as well as our editorial team. Our content team does not obtain direct compensation from our advertisers. The cost of financial debt is the return that a company gives to its debtholders and creditors. Expense of financial obligation is made use of in WACC estimations for assessment analysis. Each mortgage kind is created to match various scenarios and individuals, so it is very important to do your research study and also choose the one that's right for you.

That Should Obtain A Taken Care Of

If you place 20% down ($ 40,000) as well as finance the rest with a 30-year fixed-rate conventional home mortgage at 3.875% interest, you'll pay $752 a month in principal as well as rate of interest. Your complete rate of interest paid on your $160,000 lending would concern nearly $111,000 by wesley service the time your home loan is done. Okay, now allow's contrast overall interest prices between these common types of mortgage loans-- you'll see why the 15-year fixed-rate mortgage is the only means to go.