When you're purchasing a mortgage, compare rate of interest buying a timeshare from owner as well as APR, which is the complete cost of the home mortgage. Some lenders may advertise low rate of interest but counter them with high fees, which are shown in the APR . The Fed revealed that it will cut its regular monthly Click here for more Treasury and mortgage-backed safety and security acquisitions by $30 billion a month, up from the $15 billion pace that authorities establish just last month. The new pace implies the united state reserve bank will no more be acquiring bonds by March 2022, as opposed to by June 2022. The Federal Reserve does not set the specific rates of interest in the home mortgage market.

- Higher interest rates additionally influence credit lines as well as auto and trainee fundings.

- To find your most affordable funding, utilize ourTop Loans Quick Eligibility Calculatorand it'll tell you which you've the most effective possibility of getting, without hitting your creditworthiness.

- The first point to take into consideration here is just how the lender is funding its home loans.

- While it had not been a planetary shift in the UK's economic situation, it represented a worrying dive for those with mortgages.

Personal aspects, such as credit rating, earnings, as well as the type as well as size of the funding you desire, will after that enter into play to establish just how much you'll be credited obtain a finance to get a house. This week, though, the state of mind music altered quickly as a Financial institution of England rate surge was mooted-- as well as although quickly denied, led high street loan providers to enhance home mortgage prices. Now analysts are anticipating that the Bank will certainly increase the base price at the following conference of the Monetary Plan Committee, in December. Therefore, the poll exposed Canadians favour fixed price home loans by a 4 to one ratio with 71 percent of respondents having or intending to obtain a set price home loan.

If the MPC feels that the economic climate would certainly take advantage of higher borrowing as well as costs by organizations and customers, it reduces the base price. When the Bank of England provides money to industrial banks, the financial institutions must pay interest, and the amount is identified by the base price. Info provided on Forbes Consultant is for instructional functions only. Your economic scenario is one-of-a-kind and also the services and products we examine may not be appropriate for your circumstances. We do not provide monetary suggestions, consultatory or brokerage firm services, nor do we suggest or recommend people or to acquire or sell particular supplies or safety and securities.

We follow rigorous guidelines to ensure that our editorial content is not influenced by advertisers. Our content group receives no direct payment from marketers, and our material is thoroughly fact-checked to make sure accuracy. So, whether you read an article or a testimonial, you can rely on that you're getting reputable as well as trustworthy details.

Exactly How Do Fed Rate Of Interest Influence Home Loan Rates

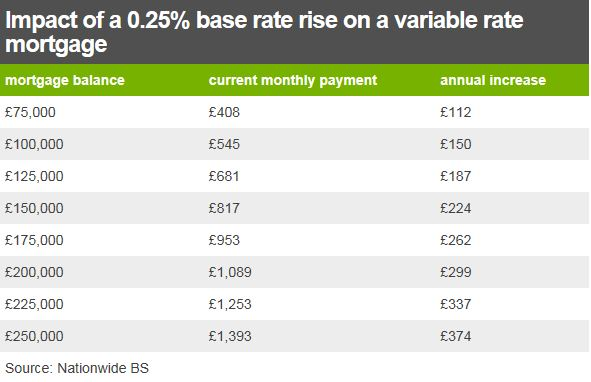

Much of those with cost savings depend on interest payments from the bank to provide essential revenue to survive. So whether you're a saver or a borrower, the level of rates of interest for you and also your family members, truly does issue. While financial institutions might be charging more for car loans, they might likewise be paying a somewhat higher rate of interest on interest-bearing accounts. On a typical variable rate it is less straightforward-- these can change at the lending institution's discernment. Most analysts state there is no factor for banks as well as developing societies not to hand down the complete rise, so you need to anticipate an increase. As an instance, HSBC's common variable rate is 3.54%; if it passes on the full increase borrowers paying it will certainly transfer to a rate of 3.69%.

Retired Life Calculators

A bull steepener is a modification in the return contour as short-term rates drop faster than lasting rates, leading to a higher spread between them. The 5/1 crossbreed ARM is a variable-rate mortgage with an initial five-year set interest rate, after which the rate of interest changes every one year according to an index plus a margin. House costs have enhanced https://eduardohrnp252.hpage.com/post5.html by almost ₤ 31,000-- more than the average UK income-- because the beginning of the pandemic, according to Nationwide Structure Society. Absolutely nothing has actually stood in the way of the upward trajectory of the building market, completion of furlough and also stamp task alleviation having passed without event. Imagine you have a ₤ 130,000 home loan that you wish to settle over 25 years. If the rates of interest on the home mortgage is 2.5%, the month-to-month repayment will be ₤ 583.

Will It Have Any Various Other Effect On My Finances?

Mortgage rates of interest figure out just how much you'll be credited borrow and also buy a residential property, as well as what your regular monthly repayments will be. Figure out just how they work and just how to obtain the best home mortgage rate of interest. These home loans 'track' the Bank of England base price, plus a set margin - for example, the base price plus 1%. Like fixed-rate home loans, these offers tend to last for a set variety of years before returning to a lender's SVR. With easy-access savings items, where you can withdraw the cash whenever you want, rate of interest are variable, suggesting lenders could hand down an increase in the form of better rates.

Financiers anticipate the rate to rise over 1% by the end of 2022, the largest acceleration given that 2006. You can also have a talk with an advisor about changing your cost savings and also financial investments to take advantage of rising interest rates. They may be able to aid you locate remedies that offer a much better return as rates go up.

That consists of the financing and also financial savings prices used by high street banksand structure societies. "Refinancing a mortgage can still trim $100 to $200 off of your regular monthly repayment, and that provides important breathing room when the expense of many various other points get on the surge," Bankrate's McBride stated. The central bank will strongly take a break in 2014's bond purchasing faster than initially planned after current records on rising cost of living continued to reveal a sharp increase in costs. Remain in the know with our newest home tales, mortgage rates as well as refinance suggestions.